In this article, you’ll learn:

Mergers & Acquisition (M&A) is the DNA of the modern business. At a certain point, the company reaches critical mass. At that stage, it makes more sense for them to join forces with companies in the competing/auxiliary industries instead of building a project from the ground up. This year, cloud computing company Salesforce acquired Slack for $27.7 billion. The speculation about the deal seems to suggest that Slack sought a powerful distributing partner to help them go toe-to-toe with their main rival in B2B messaging scene - Microsoft.

In 2006, Activision merged with Blizzard, forming Activision-Blizzard, one of the largest gaming publishing and development companies in the world. Although both were exceptionally successful in their regard, Activision sought to tap into Blizzard’s established digital presence, whereas Blizzard needed Activision’s expertise in the marketing and distribution of the product.

So, when we’re talking about M&A, we don’t necessarily mean a scenario in which Company A is slacking, and Company B hungers to pick up the leftovers… Although, in the public’s view, this perception is the most established.

Whenever a company with a questionable reputation on the market picks up a beloved doll, the public outcry can threaten to erase all the goodwill that was one of the motivators for the acquisition in the first place. In 2014, when Facebook (now rebranded as Meta) purchased Oculus, a pioneer in VR technology. Although both managed to remain successful almost a decade later, Oculus’ reputation as Facebook’s bedfellow still tarnishes the brand.

For those reasons, it is important to brainstorm a successful branding strategy when going through M&A. Even if you’re not planning a full-scale rebranding, a proper branding strategy can make or break the success of your endeavour.

Great Examples of Effective Re-branding During Mergers & Acquisitions

Orange & T-Mobile: Playing the Long Con

These two telecom giants were successful in their ways before the merger. In 2010, companies decided to join forces to capture the bigger market segment by providing wider coverage for both Orange & T-Mobile users.

This message - “More coverage than before, while everything else stays the same for the customer” - has been spearheaded by a rarely seen marketing campaign in which two companies released side-by-side advertisements that announced an ability to use the other one’s signal.

This campaign was called Everything Everywhere, and it ran for five whole years. In this period, people got used to two facts:

- If I am Orange (or T-Mobile) user, I can use the other one’s coverage.

- The campaign is called Everything Everywhere.

In five years, two companies announced the completion of their merger. The name of the new company? EE, short for Everything Everywhere. By that point in time, two companies managed to make that phrase commonplace in the minds of the user, so the jump from “Everything Everywhere the campaign slogan” to “EE being my new cellphone operator” didn’t feel as jarring as if the company had attempted that rebranding overnight.

Telecommunications is a precarious sector where familiarity is important. Close friends and family might use the same provider to call each other faster, so if there was any confusion about what this merger entailed, there was a risk of customers simply switching to something they understand. Thankfully, EE showed a masterclass in how to do things right.

DHL, Medtronic, and The Stronger Horse Paradigm

When two companies go through M&A, there might be a decision to erase one company’s identity and continue operations under a unified umbrella. There are multiple reasons to opt for such a strategy. Most of them concern the perceived superiority of one company over another. Hence, the “stronger horse” moniker). In some scenarios, this can be seen as a welcome upgrade for the customers of the consumed company. When delivery giant DHL purchased Airborne Express in 2003, the latter’s customers benefited from DHL’s logistics and service providing the experience.

A stronger horse paradigm doesn’t always require extensive asset revision, as many assets might remain the same. However, some companies still opt to do slight tweaks to the formula. For example, when Medtronic purchased Midas Rex. The company combined two logos and operated under Medtronic Midas Rex identity until eventually dropping the second part of their name.

Such an approach eases the transition into a unified identity without scaring away the customers of the “weaker” horse.

Although, such an approach isn’t without its flaws. The “losers and winners” fallacy implies that the company whose name disappears had lost and might be perceived as a failure by investors and customers, not to mention the overhaul of a company culture that might scare away the employees. In such mergers, it is important to emphasize that the core values and principles of the “weaker” horse will remain in place.

Activision-Blizzard: Fusion

Fusion makes the most sense when two companies work in the same sector and have a comparable reputation that neither wants to lose. An abrupt disappearance of a company’s name might confuse and lead to loss of sales that relied on brand recognition. In 2006, Acti-Blizzard opted for a quite trivial combination of two brands’ identities, without even bothering to redesign either’s logos substantially.

Such an approach signalizes that the two companies joined forces but that they will still focus on the things that they do best. Indeed, for as long as the company existed, neither half had meddled too much in other’s affairs.

Microsoft & PG: It All Remains the Same

This approach is more prevalent in acquisitions rather than mergers. Acquiring company’s pull is exponentially higher than that of the purchased company. Microsoft’s acquisition strategy is a great example of how this works. The software giant is always hungry, recently buying ZeniMax Media for $7.5 billion. Yet, like with their Skype and Mojang acquisitions, these companies do not become a part of the Microsoft brand and still run and distribute their product lines under the original names.

Besides the incomparable sizes of the companies, another compelling reason for that strategy is the diversification of assets. When a large company branches out into completely different niches, it makes more sense to maintain separation of the branding. It allows each company to focus its marketing efforts on things they do best without jeopardizing the others. A famous graphic depicting companies owned by P&G is a good example of that:

How Digital Assets Management Can Help With M&A Re-branding

In the majority of the cases of rebranding due to M&A, one thing remains static - assets. Videos, images, photos, all kinds of marketing materials - you need to have them and you need to update them to correspond with new vision.

But here’s the problem. When we are talking about companies that go through M&A, we are thinking about hundreds if not thousands of assets. These assets are distributed across several social media channels, websites, etc. This scenario begs a question: in such a precarious situation (when even the masterfully executed rebrandings can elicit a backlash), how do you ensure that your digital assets remain on their best behavior?

The answer is digital assets management system, such as Pics.io. Designed to streamline collaboration, distribution, and maintenance of your digital assets, Pics.io will help to make your life just a notch bit easier through all steps of this tenuous journey.

Onboarding new teammates with DAM

A common thing with mergers is a reshuffling of teams and departments: some people leave, other join, and sometimes two teams from two companies can merge into one.

The chaos of ensuing water cooler dynamics aside, how do you manage everyone’s permissions and ensure that you don’t accidentally give permissions to tweak your assets to someone that really shouldn’t be doing that?

If you used Pics.io as your single source of truth for all things assets-related, there is a quick fix for that. Before you invite teammates to Pics.io, you need to assign a role to them, each role having different permission of what they can do with assets.

You can even set up these restrictions on a collection basis. So, for example, if you have two marketing teams, you can create a separate collection for each. Then, you can set the rules such as: “Team A marketing team can do whatever they want with Collection A, but can only view and comment on assets from Team B”

That way, there is no need for constant reminders about touching this or that. Pics.io will do it by itself, as permissions won’t allow people to tread where they shouldn’t.

Data Migration from Cloud Storages

As companies change and evolve, so do their media organizing paradigms. A task of transferring assets from one solution to another is a daunting one, as it poses risk of data losses during inattentful transfer. Smart DAM solutions understand that, and we tried to streamline data migration as much as possible.

There is also an option to delegate this task to our professionals, who'd done that many times over.

Asset Update & Maintenance

If you ever worked with multiple revisions of a single image or a video, you know how much of a hassle it can be. Design overhaul here, slight error there, and you wind up with a folder with 100 images, and you don’t remember the design that your team agreed upon. With digital brand management tools, it becomes significantly easier thanks to how we track the new versions of the file.

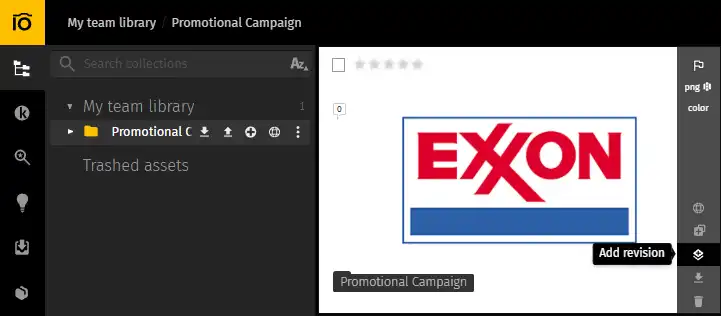

In Pics.io, you access all versions of the asset through one thumbnail. That’s how you upload revisions as well.

Let’s say we’re Exxon’s marketing team, preparing our merger with Mobil. So I just go to the collection with the logo and click Add revision.

Once it’s done, I can bring up the asset’s info panel and access each version by clicking on a required revision.

I can also compare the revisions side-by-side with a handy slider:

So, there’s no need to constantly point sales, marketing, and other teams in the direction of the up-to-date version of an asset, as the most recently approved revision will always appear on top. They can just grab that and use it wherever they need to.

Sharing Assets

There also might be a need to share assets outside Pics.io. For example, your team is already using DAM and all its benefits, but the new people aren’t up to speed/you haven’t invited all of them just yet.

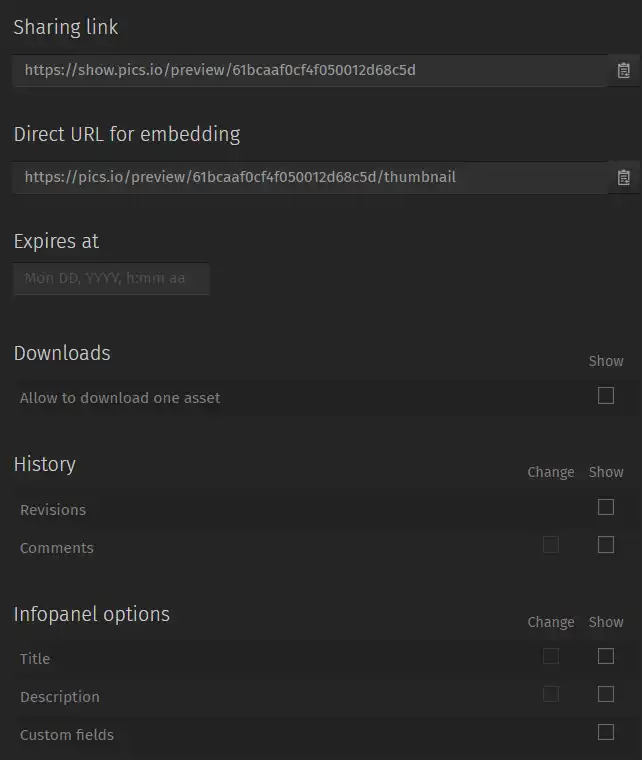

Distributing assets outside of Pics.io is as easy as uploading. I just click Share toggle on the asset’s info panel to generate a direct link to an asset, and I’m good to go.

There is also an option to specify sharing permissions. Maybe you don’t want someone outside Pics.io to see revision history or download an asset. It’s all enabled through a few simple clicks.

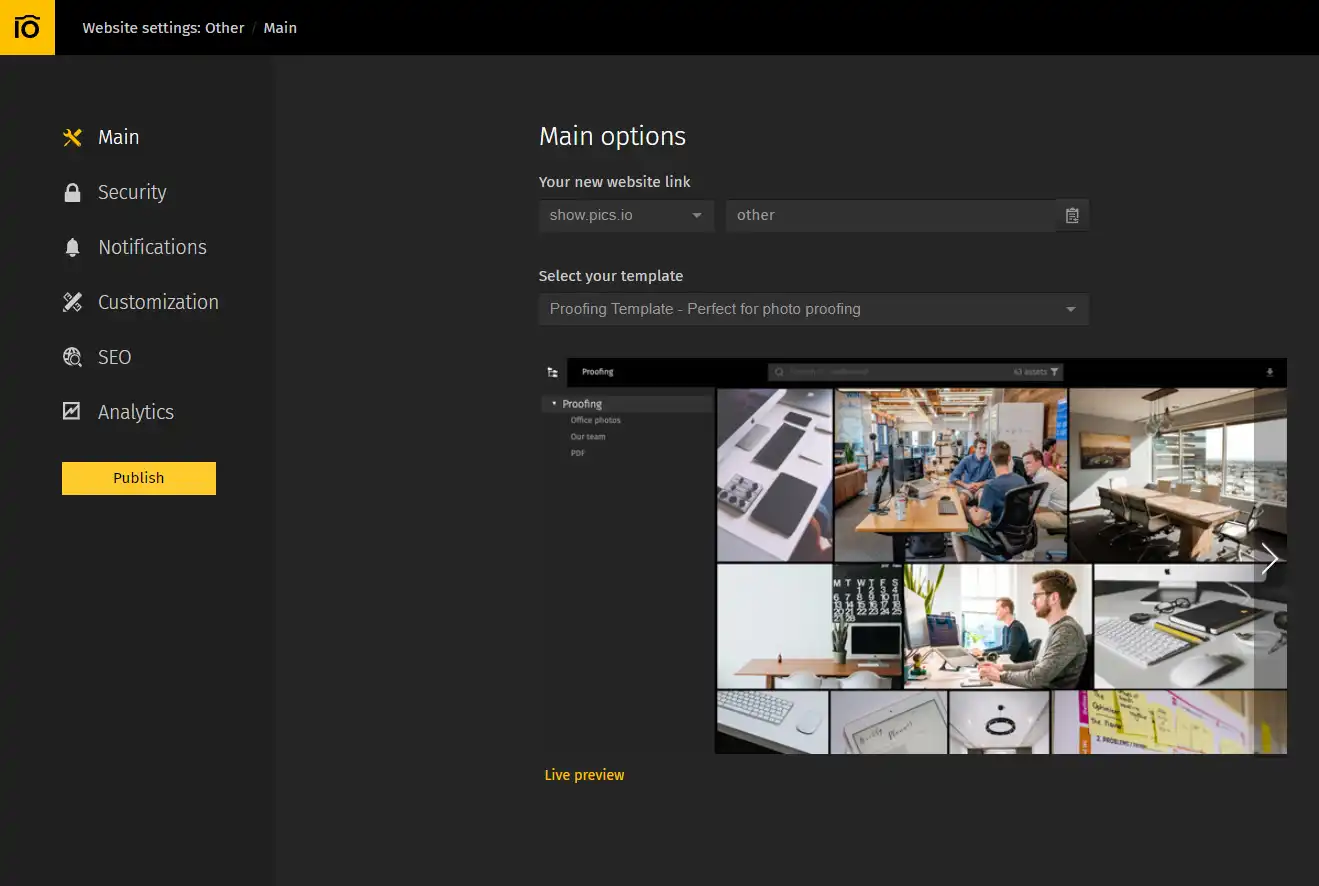

And you can do that with multiple assets, as well by creating websites through templates. The process is eerily similar to the one shown above, the only difference being that you need to select a collection (not just one asset) that you’d like to publish and choose & customize the template that you wish to use:

Summing It All Up

Mergers & acquisitions are difficult beasts to wrangle. Every misstep with branding can further confuse and aggravate the public that isn’t always happy with mergers in the first place.

To guarantee your success, you need the right tools for the occasion. Tools such as Pics.io, which you can try today, for free. We’ve also helped many clients on their re-branding journeys, so if you’re still not sure if this is the right option for you or you have questions that we haven’t covered, talk with us! We’re always here to help. See you around! ;)

Curious? Learn more about Pics.io or book a demo with us and we'll answer all of your questions!