Published: November 11, 2021

Updated: January 8, 2026

In this article, you’ll learn:

Brand awareness in B2B SaaS is simple and useful: your target audience remembers you when the problem shows up — and your potential customers trust you enough to click and shortlist you.

If you’ve ever felt like your growth depends on constant campaigns (and everything drops the second you pause), that’s usually a brand-awareness gap. This guide helps marketing leaders build a repeatable brand system for a SaaS company in a competitive market — without relying only on marketing campaigns.

What “Brand Awareness” Means for B2B SaaS

In a competitive market, business buyers and decision makers choose brands they recognize and trust — that’s the core of brand marketing in the SaaS industry. B2B buyers learn the category, compare options, build internal consensus, and only then commit. Brand awareness helps you in two ways:

- It makes you show up earlier — so you’re not trying to “win” in the last week of a long buying journey.

- It speeds up the shortlist stage because your name already feels familiar and “safe.”

A clean way to think about it is:

- Awareness: “I know this brand exists.”

- Consideration: “This could be a fit for us.”

- Preference: “This is one of our top choices.”

Your message and brand identity should stay consistent across the entire customer journey to improve brand recognition and brand perception.

How to Measure Brand Awareness in B2B SaaS

Pick three to five KPIs and track them monthly. These key metrics are easy to track in Google Analytics and your CRM, and they connect brand work to measurable outcomes like conversion rates and pipeline. Here’s the smallest set that works well in real life:

| Metric | What it tells you | Where to track | How to calculate |

|---|---|---|---|

| Branded search volume (brand + product name) | People remember you and actively look for you | Google Search Console + SEO tools | Track impressions/clicks for branded queries; use the same query set every month |

| Share of search (brand searches vs competitors) | Relative mindshare in the category | SEO tools (exports work fine) | Your branded searches ÷ (your + top 3–5 competitors’ branded searches) |

| Direct traffic trend | People type you in / return later | Analytics | Track direct sessions and returning users; watch trend, not one month |

| Branded conversions (demo requests from branded traffic) | Awareness turning into pipeline | Analytics + CRM | Filter conversions where landing session includes branded query / branded landing page; also check assisted conversions |

| Reviews / mentions trend | Trust signals and social proof | G2/Capterra/TrustRadius + PR monitoring | New reviews per month + average rating + volume of brand mentions |

Two important notes:

- Any single metric can be misleading. Trends across a small set are more reliable.

- Brand is a lagging lever — you often feel it in the pipeline after you see it in branded search and direct traffic.

If you track only demand metrics, you’ll miss early signals of brand impact — awareness usually moves before customer acquisition becomes cheaper.

Baseline first: capture the last 3–6 months for branded search, direct traffic, branded conversions, and your top competitors for share of search. That’s your “before” picture.

Step 1: Positioning That’s Easy to Repeat

Most awareness work fails because the message changes every week. That’s why you need fewer competing storylines.

Write one positioning statement your team can repeat without thinking:

We help [ICP] solve [pain] by [how], so they can achieve [outcome]. Unlike [alternatives], we [differentiator].

A clear value proposition (and a strong value proposition you can repeat) is the foundation of brand building and effective SaaS marketing.

Then keep a short “message hierarchy” that stays stable:

- your core message in one sentence

- a few proof points (what makes it true)

- a few use cases (where it shows up)

- the top objections and short, calm answers.

It also helps your sales team and marketing teams stay aligned on what your brand stands for and what makes your SaaS solutions different.

Step 2: Channel Mix That Actually Builds Awareness

Brand awareness compounds when the same idea shows up across multiple touchpoints. You need to be consistent in a few places that your buyers already trust.

A practical mix looks like this:

- Owned: your site, SEO, newsletter, and a main social channel (often LinkedIn for B2B)

- Earned: guest posts, communities, podcasts, PR, “someone else’s audience”

- Partner: co-marketing, integrations, agencies/consultants serving your ICP

- Paid: small-budget awareness + smart retargeting (not “book a demo” from the first touch)

Think of this as a mix of content marketing, thought leadership, and selective paid advertising — all designed to reach your target market cost-effectively.

If your team is small, start with Owned + Partner, then add Paid once your message is steady and you’ve got enough good assets to run consistently.

8 Plays to Increase Brand Awareness for SaaS Companies

Below are eight plays that work repeatedly in B2B SaaS.

1) Category education that ranks and keeps paying you back

If buyers Google the problem before they buy, category education is your strongest “slow burn” asset. The goal isn’t a single viral post — it’s becoming the brand people keep bumping into while they learn.

What to do:

- Publish high-intent blog posts and guides that map to the customer journey and highlight real product features and key benefits.

- Support it with smaller articles that answer real questions your sales team hears

- Add a “How to choose” table + pitfalls section (people love this)

Focus on producing high quality content that creates valuable insights for job titles you sell to.

Track: non-branded organic traffic, rankings, and later the lift in branded searches.

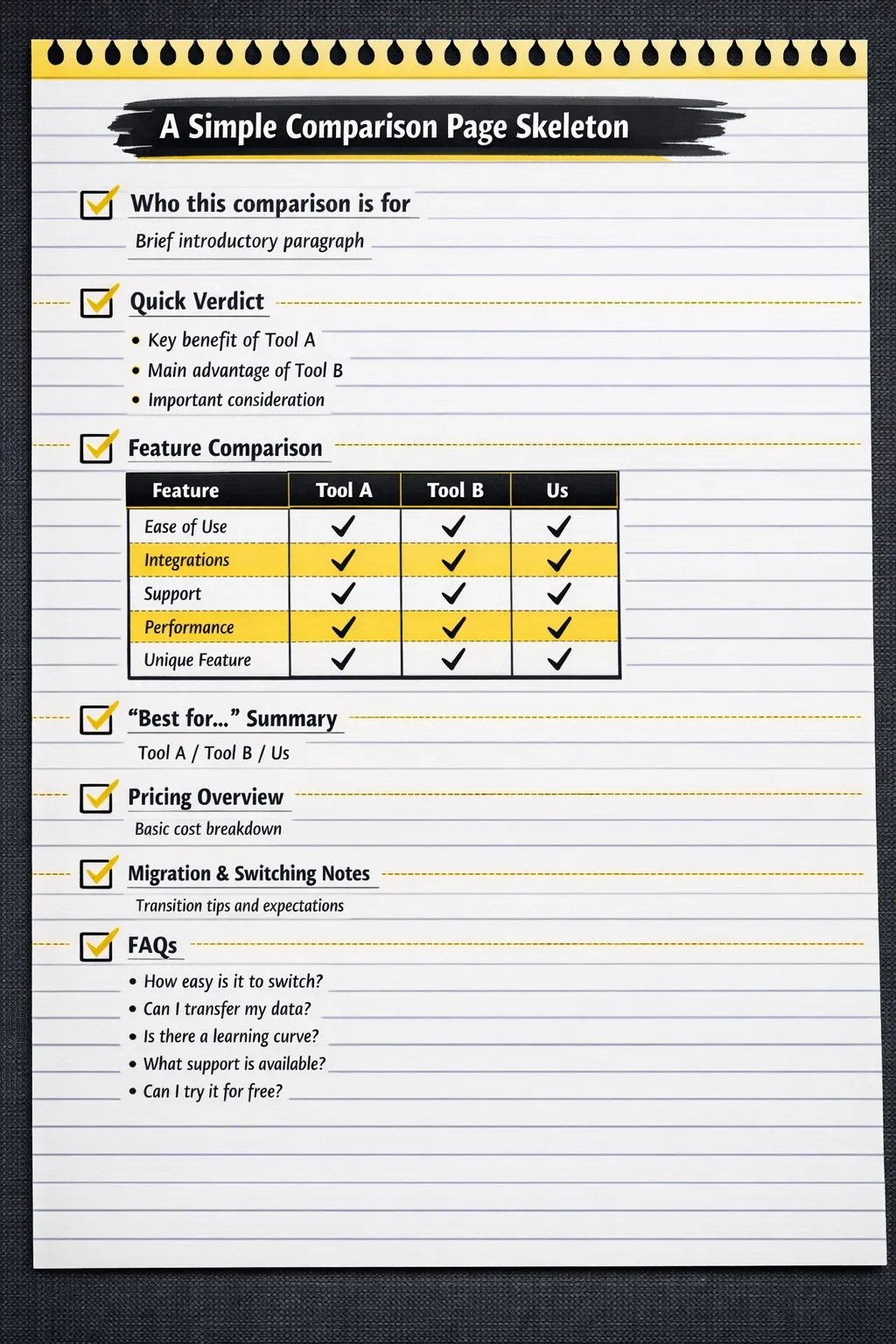

2) Comparison pages that earn shortlist attention

Comparisons are where buyers look when they’re close to a decision. The biggest mistake is writing them like an attack ad. The best ones read like a fair buying assistant.

What to do:

- Create “X vs Y” pages for the comparisons you actually see in demos

- Include a calm table, explain who each tool fits, and add “when we’re not the right fit”

- Add proof (1–2 quotes, 1–2 screenshots, 1 mini case)

Track: comparison keyword rankings, time on page, and how often these pages assist demo requests.

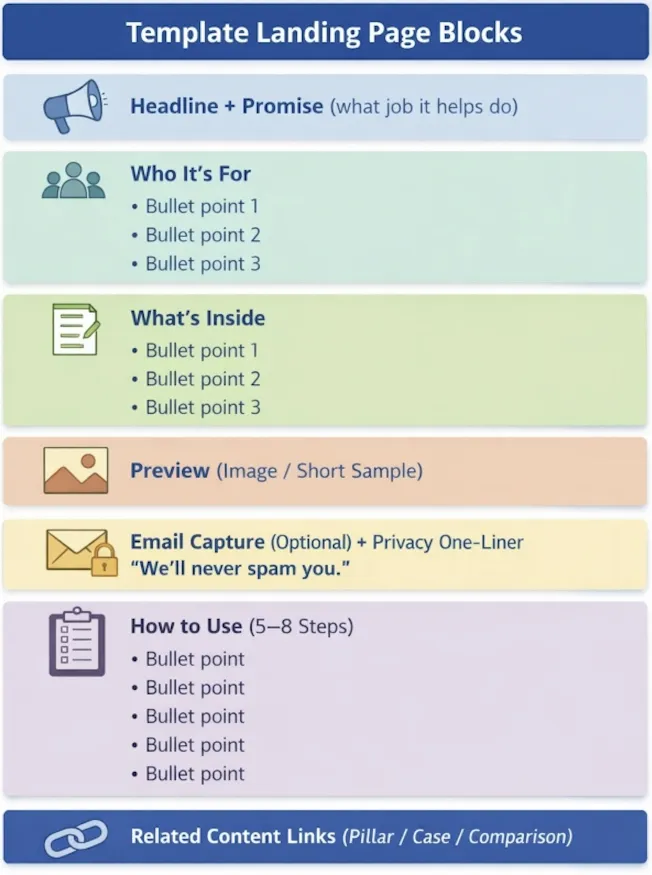

3) Free templates and calculators

Templates spread because they help people look good at work. And they’re incredibly linkable.

What to do:

- Make one practical download that matches a weekly problem (checklist, worksheet, spreadsheet, calculator)

- Put a simple landing page around it + a short “how to use”

- Add one “send to a colleague” line (quiet, but it works)

Track: downloads, new subscribers, backlinks, and whether branded search climbs as the template spreads.

4) A consistent POV series

If your market is noisy, your point of view is how people remember you. This is about clarity.

What to do:

- Pick one angle your team truly believes (e.g., “systems beat chaos” or “speed comes from consistency”)

- Publish around it steadily for 8–12 weeks

Track: repeat engagement, profile visits, direct traffic spikes after posts, and branded search trends.

5) Social proof that’s organized, not accidental

Most teams have proof, but it’s scattered: a quote in an email, a win in a call, a kind message in Slack. Make it usable.

What to do:

- Turn wins into short case snippets + build a “proof library”

- Ask for reviews at the moment of success (right after a milestone)

Track: review volume/quality, conversion on high-intent pages, and demo win-rate where proof is used.

6) Co-marketing that feels useful

Partners can accelerate awareness because you borrow trust. But only if you create something genuinely valuable together.

What to do:

- Run a monthly workshop that teaches one practical outcome

- Repurpose into clips, a guide, and a checklist

- Add a lightweight partner page (“How we work together”)

Track: referral traffic, webinar signups, partner-introduced leads, and share of search over time.

7) Community presence that doesn’t feel like marketing

This is one of the most underrated awareness plays — because it works quietly.

What to do:

- Choose 1–2 places where your ICP asks real questions (communities, Slack groups, Reddit niches, LinkedIn groups)

- Show up weekly with specific answers and examples

- Save recurring questions → turn them into site content

Track: mentions, direct traffic, and inbound leads that reference “I saw you explain…”

8) Lightweight research + PR

You need one data story that makes people say, “Oh — that’s useful.”

What to do:

- Pick one question your audience cares about

- Collect a small dataset (survey, anonymized trends, benchmark)

- Publish a short report with 2–4 charts + clear takeaways

- Pitch 10–20 niche publications / newsletters

Track: backlinks, mentions, and the long-tail organic growth that follows.

Bonus Plays That Often Matter in B2B SaaS

Reviews & listings that build trust (quietly, consistently)

For many categories, buyers check review platforms during the consideration/shortlist.

What to do: keep your listing accurate, collect reviews ethically, respond to feedback, and use reviews as proof snippets across your site.

Track: review velocity, rating trend, referral traffic from listings.

Podcasts / YouTube guesting

Being useful on someone else’s show is often faster than building a new audience from zero.

What to do: pitch a practical topic (not your product), bring a framework + examples, repurpose into clips + a summary article.

Track: branded search spikes, direct traffic, and inbound “heard you on…” leads.

When Brand Awareness Work Won’t Save You

This article and instructions won’t magically work if:

- your ICP is so narrow that nobody searches the category (you’ll lean more on partner channels)

- your message changes weekly (positioning isn’t stable)

- your product doesn’t deliver a clear, repeatable outcome (proof will feel thin)

- you can’t commit to consistency for 8–12 weeks (awareness rewards repetition, not bursts).

The Part Most Teams Ignore: Brand Consistency at Scale

Here’s the uncomfortable truth: you can do everything above and still look messy if the team can’t find the latest deck, the right logo, the approved screenshots, and the current messaging.

Inconsistent assets create inconsistent impressions. And inconsistent impressions slow down trust.

So even if you don’t think of yourself as a “brand team,” set up one simple rule: there is a single place where approved, current brand assets live — with clear versioning and sharing rules.

It’s one of the fastest ways to make your marketing feel bigger (without hiring five more people).

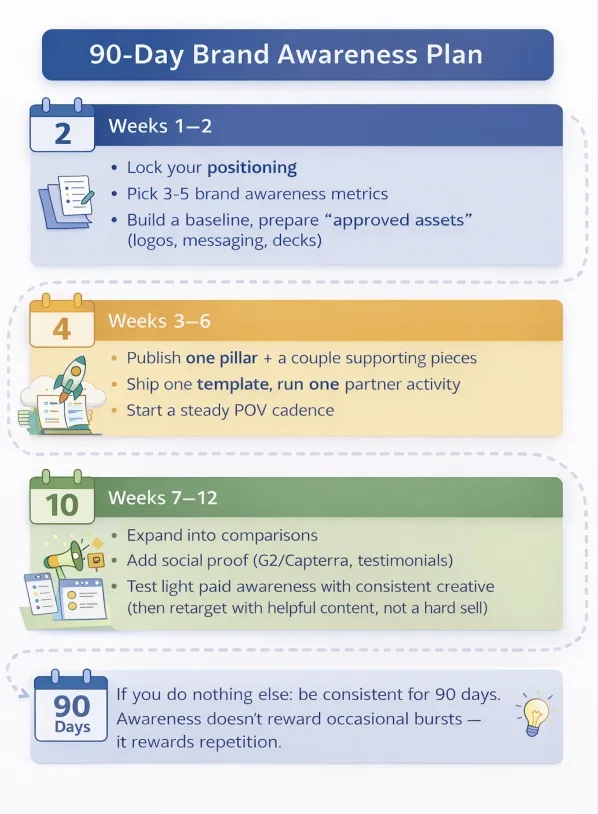

A Practical 90-day Plan

Weeks 1–2: lock your positioning, pick 3–5 brand awareness metrics, build a baseline, and prepare your “approved assets” set (logos, messaging, screenshots, key decks).

Weeks 3–6: publish one pillar + a couple supporting pieces, ship one template, run one partner activity, and start a steady POV cadence.

Weeks 7–12: expand into comparisons, add social proof, and test light paid awareness with consistent creative (then retarget with helpful content, not a hard sell).

If you do nothing else, be consistent for 90 days. Awareness doesn’t reward occasional bursts — it rewards repetition.

FAQ

How long does brand awareness take in B2B SaaS?

Usually, you’ll see early signals in 4–8 weeks (direct traffic, repeat engagement, branded search trend). Pipeline impact often shows up later — 8–16+ weeks, depending on sales cycle and market maturity.

What’s the difference between brand awareness and demand gen?

Awareness increases familiarity and trust before a buyer is ready. Demand gen captures intent when they’re ready. In practice, awareness makes your demand gen cheaper and your shortlist rate higher.

Is the share of search reliable in 2026?

It’s useful as a directional signal, not a perfect truth. It can get noisy if your category has low search volume, brand names overlap with common words, or your market shifts to more “zero-click”/ AI answers. Pair it with branded search trends, direct traffic, and conversions from branded sessions.

What metrics should a small team track without drowning in reporting?

Start with these three months:

- Branded search trend (GSC)

- Direct traffic trend (Analytics)

- Branded conversions (Analytics + CRM)

If you can add two more: share of search + reviews/mentions.

What are “good” benchmarks for branded search growth?

Benchmarks vary a lot by category and seasonality, so avoid a single universal number. A good target is steady month-over-month direction, not spikes: branded impressions rising, branded clicks rising, and branded conversion rate staying healthy (or improving).

Do review platforms (G2/Capterra/TrustRadius) really matter for awareness?

Yes — especially during the consideration and shortlist. Even if buyers don’t convert directly from review sites, reviews act like “trust infrastructure.” Track review velocity, rating trend, and how often reviews are referenced in sales conversations.

What’s the fastest awareness win if we’re already producing a lot of content?

Clean up consistency: one source of truth for approved assets, clear versioning, and easy sharing rules. It makes every touchpoint look more professional immediately — and that speeds up trust.

Wrap-up

If you want brand awareness that compounds, focus on three things:

- a message your whole team can repeat

- a distribution habit that doesn’t depend on “inspiration”

- a simple measurement stack that tells you whether mindshare is growing.

And if your team is already producing a lot of content and creatives, the fastest win is often unglamorous: make sure everyone uses the same approved, current assets — everywhere your brand appears.

Curious? Learn more about Pics.io or book a demo with us and we'll answer all of your questions!

Author

Maks PetrenkoMaks Petrenko is an Operations Manager and PhD candidate in Management who focuses on workflow optimization, performance tracking, and data-driven growth. He’s led 20+ person cross-functional teams and rolled out KPI systems across Support, Marketing, R&D, and Sales — reducing returns from 26% to 10%, increasing activation from 8% to 13%, and quadrupling MQLs in six months.